As a nonprofit with tax-exempt status, Family Promise of North Idaho is considered a qualified charitable organization by the U.S. Treasury. In the U.S., qualified charitable organizations are known as 501(c)(3) organizations. 501(c)(3) refers to the portion of the IRS code that deals with the tax treatment of nonprofits.

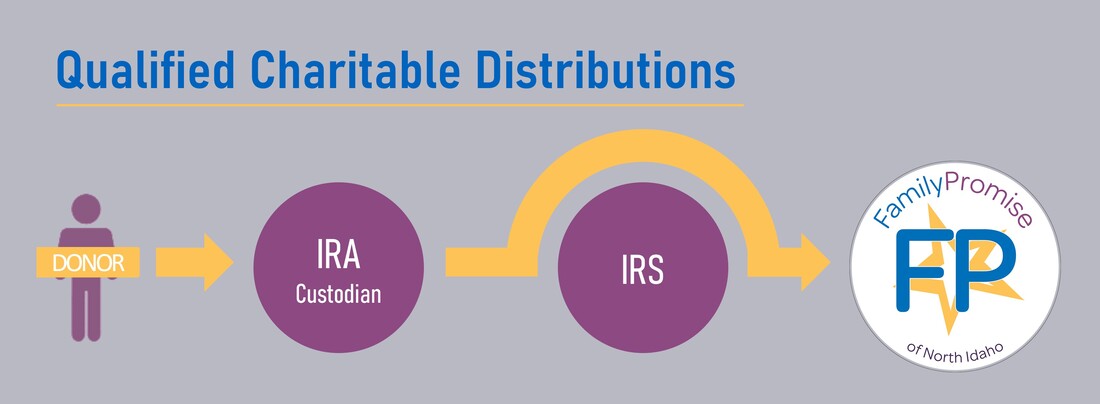

A Qualified Charitable Distribution (QCD) is a distribution from your IRA, which goes directly from your plan’s custodian to a qualified charity. Family Promise is now able to accept QCDs and we encourage individuals or couples who are considering making such a gift to consider us. For information about how to set up your contribution, please click on the button below. If assistance is needed, contact us at 208-818-5924 or by emailing [email protected].

Reminder to IRA owners age 70½ or over: Qualified charitable distributions are great options for making tax-free gifts to charity | Internal Revenue Service.